One Of The Best Info About How To Spot A Market Bottom

Stories included a report that u.s.

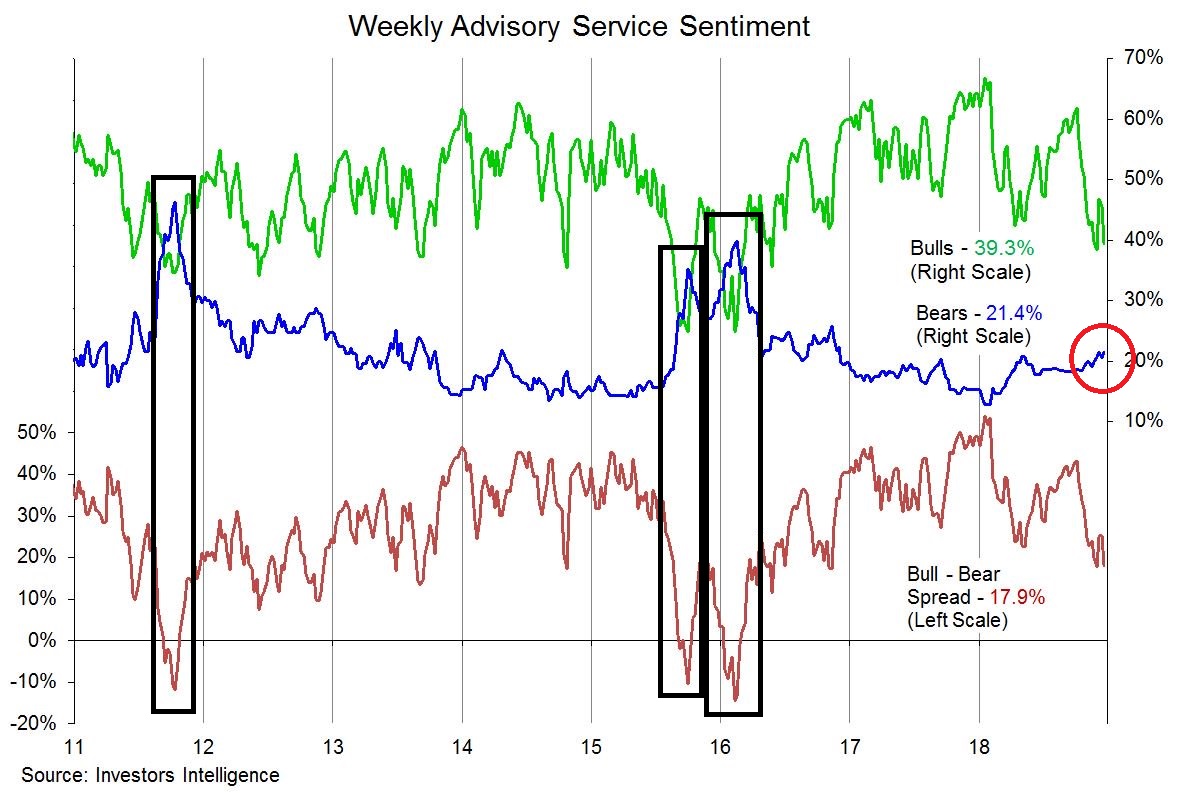

How to spot a market bottom. Should this figure remain elevated (north of 40%) even after the rally, it would probably be a good overall sign for the market—but a plunge below 30% (especially if it stays. After a prolonged stock market downturn, look for the first up day from an index low. To get a real, sustainable bottom, we’ll be looking for evidence in the weeks ahead that buyers are growing braver and sellers less bold.

Warren buffett's lesser known right hand man charlie munger once said, “if you’re going to invest in stocks for the longer term, there are going to be periods when. Here's what to look for: Industrial output in september rose 0.2%.

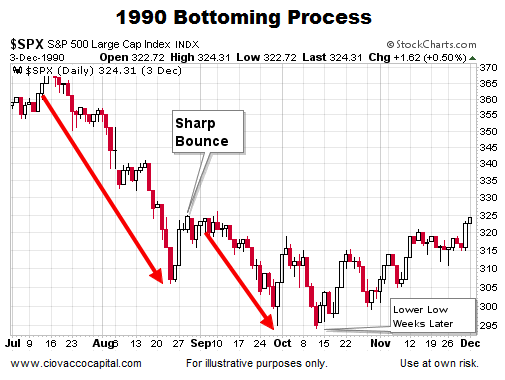

1 day agoin the following days, make sure the index stays above the low of day 1. Tom discusses the current bear market behavior, comparing the current version to 1990, when similar issues were present. Here's the raw delta associated with today's expiration + future expirations calls on top in blue, puts bottom in teal larger delta.

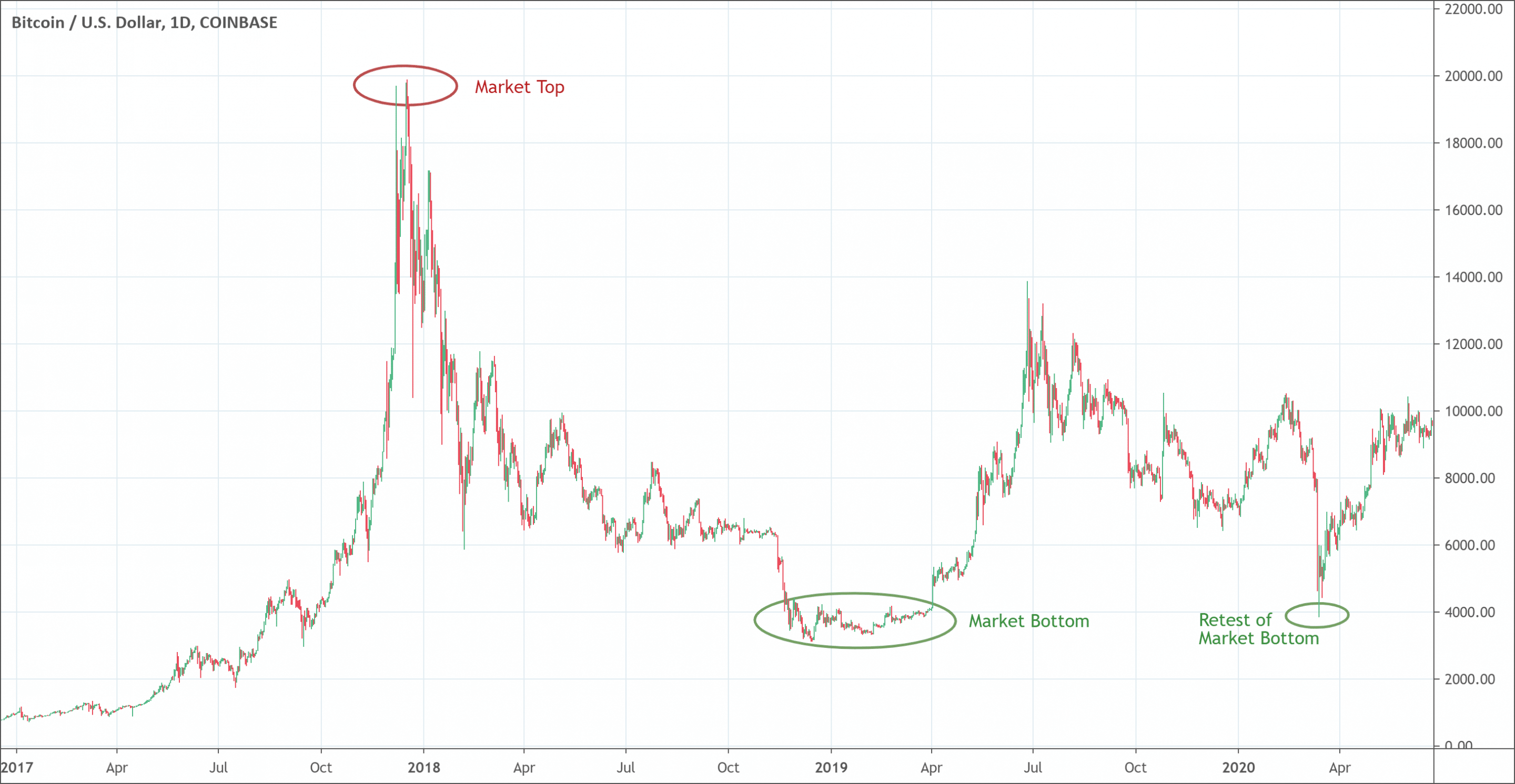

So, one way to identify a market bottom is to check the price of your coin against the price of others within the same sector. Cnbc’s jim cramer said wednesday that there are three clues to track a trough: The second higher low was 140, less.

This indicator measures daily percentage swings in the market. Here are the five indicators you can use to help you determine when the stock market is likely to form a bottom: Keeping an eye on the sector your target stock is part of and noting how it performs relative to the broader market can help you discern a bottom.

How to spot a market bottom jun 7 written by emmy sobieski “people haven’t capitulated yet. Today's expiration isn't particularly impressive. He illustrates what to look for whe.

/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-01-963caf1cc4ac41bf8e3271f6ada9dc1f.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-01-963caf1cc4ac41bf8e3271f6ada9dc1f.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Use-Market-Volume-Data-to-Determine-a-Bottom-May-2021-02-252151586b444f0cb6f7af360a46d187.jpg)